Self Managed Super Funds And Property Investment: Information You Need To Know

What is an SMSF?

A Self Managed Super Fund is a trust you use in order to manage your own superannuation. Basically instead of the employer provided super fund, you have direct control over your assets. This enables you to choose where you invest your money for your retirement.

A Self Managed Super Fund is a trust you use in order to manage your own superannuation. Basically instead of the employer provided super fund, you have direct control over your assets. This enables you to choose where you invest your money for your retirement.

You can put the money in a number of different places including capital investments such as shares and property. Each different investment comes with a variety of risks.

What laws and restrictions will affect investing in property?

Whilst is is possible to use your fund to invest in property, there are certain laws and restrictions that can affect your eligibility and limit the options you have available.

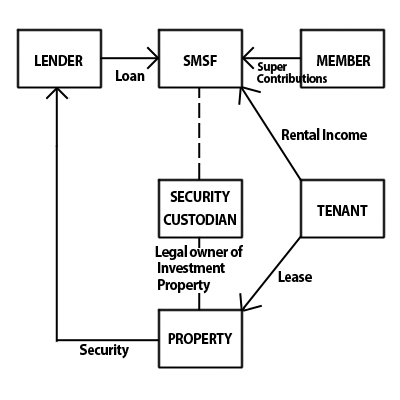

Some examples of the legal conditions under which an SMSF can borrow money include;

- The asset is an asset that the SMSF (you) could legally otherwise acquire if it had available funds

- A security trust (security custodian) holds the asset until all repayments are made.

- Once all repayments have been made the SMSF must have the right to acquire legal title of the asset from the Security Trustee

How much you can borrow with these loans differs from normal mortgage applications. Standard investment loans are offered at up to 80% of the property value however lenders usually restrict the amount to 72% or 75%.

It is also important to note that loc doc loans are not available and the fund must be able to prove it can repay the loan.

Which banks and lenders can help and what interest rates are available?

Many banks are not willing to lend to SMSFs. They believe that the loans are more complex and lead to less profit. However there are a number of lenders that do not see it this way and are willing to assess an application. These can be difficult to find however without professional help from a mortgage broker.

Interest rates for SMSF loans are higher than for normal property purchases. Depending upon your circumstances and the risks the lenders perceive, low interest rates may be available. However as there are large differences in pricing between the major lenders this depends largely upon which bank you apply to.

What are the risks associated with investing in property this way?

Property is what is called a capital growth investment and can be useful for capital gains and tax benefits using negative gearing and depreciation allowances. However as the global financial crisis showed, value can fall from time to time possibly leading to large capital losses.

As for cash flow, the property may be vacant or tenants may not pay rent and you may default on your repayments. If the situation arises where you need money it is also difficult to sell quickly at a high price.

How Should I Apply?

Applying for a loan on your own can be difficult. There are not too many lenders willing to lend to SMSFs and each declined application will affect your eligibility next time around as it will go on your file. Even if you find a lender yourself, such as your current bank, you are unlikely to be offered the lowest interest rate.

Applying through a mortgage broker that works with many different lenders and specialises in different loan types such as SMSF loans, is the safest option. As they know the lending criteria of the banks they are aware of who offers these loans, where you may be eligible to apply and who may have the lowest interest rates.

Do you have approximately $150,000 in your Superannuation? If you do, you may be eligible for a Self-managed superannuation fund (SMSF) loan to purchase real estate with your Super!

Do you have approximately $150,000 in your Superannuation? If you do, you may be eligible for a Self-managed superannuation fund (SMSF) loan to purchase real estate with your Super!