Do you have approximately $150,000 in your Superannuation? If you do, you may be eligible for a Self-managed superannuation fund (SMSF) loan to purchase real estate with your Super!

Do you have approximately $150,000 in your Superannuation? If you do, you may be eligible for a Self-managed superannuation fund (SMSF) loan to purchase real estate with your Super!

A vast number of major mortgage brokers and bank managers do not understand SMSF Loans as they are complex and they do not deal with them on a daily basis. This means that errors can be made, and loans declined purely because of their lack of understanding; as such it is strongly advised that you seek expert advice when considering Self Managed Super Fund borrowing.

There are also significant differences between policy and pricing between different banks, so speaking to a specialist mortgage broker such as The Home Loan Experts will ease the confusion that you would face dealing with the different financial institutions directly. You can find out more about their services on their Self Managed Super Fund Loan information page.

What are the benefits to borrowing in your fund?

Since the Superannuation Industry Supervision Act 1993 (SIS ACT) was amended in September of 2007, Funds now have the ability to borrow for Property Investments. This allows DIY Super Funds to take advantage of the same benefits as regular property investors.

Below are some of the benefits available to SMSF loans: (Please note: SMSF loans are also commonly referred to as Warrant Trust Loans, Instalment Warrants or SMSF Trust Loans.)

- Reduces tax rate on rental income to 15%

- Tax advantages on sale of investment property

- Super Funds are able to purchase property worth more than it’s available funds through the benefit of gearing

- You can use income from the security to help pay off the loan

- Extensive tax deductions can be claimed by the Super Fund

- Funds receive all income and capital growth, even if the property has not been paid off as yet

- Superannuation assets are secure, as the lender does not have recourse to the SMSF’s other assets in the event of default

How do I purchase a property with my SMSF?

Self-managed Superannuation Funds can choose any type of property as investment; these investment properties include Commercial, Residential, Holiday Units and Retail. However, you must ensure that the property complies with the SIS ACT, the SMSF’s overall investment strategy (Superannuation funds must have a written investment strategy in place), and that the Fund has sufficient equity to complete the purchase.

Here are some basic guidelines as to how a SMSF purchases a property: (Please Note: The SMSF must purchase property from an unrelated party. Purchases must be at arm’s length.)

- Establish your SMSF – The Trust Deed establishing the fund must have the power to Purchase Real Estate, Borrow Money, and Mortgage Property to secure payment of that borrowing

- Obtain a loan approval – it is recommended to obtain a Pre-Approval on your Superannuation Fund before paying your deposit

- Establish the property Trust Deed – this is something that your accountant or financial adviser will need to create. It is also important that the SMSF Trustee itself is not the Property Trustee, nor are the individual member of the SMSF are to act as Property Trustee – as this will breach the regulations of the SIS ACT

- Exchange of Contract – deposit to be paid from Superannuation Fund

- Formal Approval – Once Valuation on security is completed the lender will issue a Formal Approval

- Loan Documents Issued – The lender will have their solicitor prepare loan documents and issue to you

- Settlement – On completion of the purchase the Property Trustee mortgages the property to the lender

How is the loan structured?

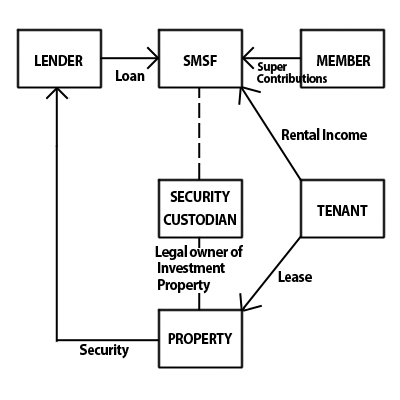

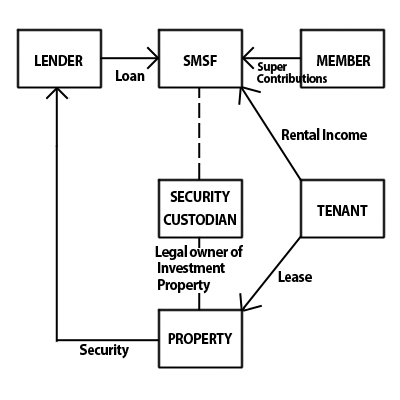

The property itself is owned by a security trustee. You can click on the below picture for a detailed flowchart of how the mortgage & ownership of the property will be setup.

What are the features of a Super Fund Loan?

- Members of the SMSF are unable to reside in the investment residential property – however they can do so after retirement, providing it is transferred from the SMSF before hand

- The lender has no recourse to the other assets of the Super Fund, providing the SMSF with absolute protection for its other assets

- The Super Fund receives the income from the investment property

- The legal owner of the real estate will be the Property Trustee

- The beneficial owner of the real estate is the Super Fund

- The Fund can make any adjustments to the property as it sees fit (e.g. Lease, renovate, repair, or sell) providing this is in conjunction with the loan terms

- The SMSF has the ability to reduce or pay out the loan at any time (subject to the terms and conditions of the lender and loan)

- After the loan is repaid to the lender the legal ownership of the security will be transferred to the Super Fund – repayments of the loan are made from the SMSF

Compare Lenders

Below is a quick comparison of the policies used by some the major lenders we deal with for super fund loans:

Lender 1:

- Repayments: Principal & Interest

- Loan Term: 30 years (residential), 15 years (commercial)

- Maximum loan size: $4,000,000

- Maximum LVR: 80% (residential), 65% (commercial)

- Security: Residential or commercial

Lender 2:

- Repayments: Principal & Interest

- Loan Term: 25 years (residential), 15 years (commercial / rural)

- Maximum loan size: $5,000,000

- Maximum LVR: 80% (residential), 60% (commercial), 50% (rural)

- Security: Residential, commercial or rural

Lender 3:

- Repayments: Principal & Interest (fixed rates available)

- Loan Term: 30 years (residential)

- Maximum loan size: $500,000

- Maximum LVR: 80% (residential)

- Security: Residential

Seeking advice – how important is it really?

There are number of rules and regulations regarding establishing a Self-Managed Superannuation Fund and planning for your retirement.

As such it is highly recommended that you seek professional advice by selecting a qualified accountant, and a specialist mortgage broker. You can find out more about borrowing in your super fund the Home Loan Experts SMSF Trust Loan page.

It goes without saying that you should obtain professional tax and legal advice before establishing your own Super Fund, purchasing a property in a fund or applying for a mortgage with your fund.

Mortgage brokers play an important part in the success or failure of the economy. They facilitate the sale of mortgage loans, and make it easier for borrowers to find the best deal on a home loan. You can think of your broker as the middle man between you and your lender. Since it is less than easy to find the right lender for the right price, it is in your best interests to take advantage of the broker’s intimate knowledge on the subject.

Mortgage brokers play an important part in the success or failure of the economy. They facilitate the sale of mortgage loans, and make it easier for borrowers to find the best deal on a home loan. You can think of your broker as the middle man between you and your lender. Since it is less than easy to find the right lender for the right price, it is in your best interests to take advantage of the broker’s intimate knowledge on the subject.

The Foreign Investment Review Board (FIRB) examines applications from overseas citizens (This includes those who live in Australia on a 457 Working Visa, and subclass 309 or 820 Temporary Resident Visas) who are looking to invest in property in Australia.

The Foreign Investment Review Board (FIRB) examines applications from overseas citizens (This includes those who live in Australia on a 457 Working Visa, and subclass 309 or 820 Temporary Resident Visas) who are looking to invest in property in Australia. Do you have approximately $150,000 in your Superannuation? If you do, you may be eligible for a Self-managed superannuation fund (SMSF) loan to purchase real estate with your Super!

Do you have approximately $150,000 in your Superannuation? If you do, you may be eligible for a Self-managed superannuation fund (SMSF) loan to purchase real estate with your Super!

You may be disheartened by financial institutions that keep turning you down. The simple reality is that many banks see you as a higher risk because you are not as financially committed to staying in the country as an Australian Citizen or Permanent Resident. However not every lender has strict lending policies for foreign citizens living in Australia.

You may be disheartened by financial institutions that keep turning you down. The simple reality is that many banks see you as a higher risk because you are not as financially committed to staying in the country as an Australian Citizen or Permanent Resident. However not every lender has strict lending policies for foreign citizens living in Australia. When you apply for a mortgage, your lender will calculate the Loan to Valuation Ratio (LVR) of your loan. This is an important part of their assessment criteria. The higher your LVR, the higher the risk to the bank in the event that you default on the loan.

When you apply for a mortgage, your lender will calculate the Loan to Valuation Ratio (LVR) of your loan. This is an important part of their assessment criteria. The higher your LVR, the higher the risk to the bank in the event that you default on the loan. Home Loans for Doctors on a 422 Visa

Home Loans for Doctors on a 422 Visa Significant numbers of first home buyers get their foot into the property market buying buying a property off of their parents or a family member. If the parents have several investment properties then they may even choose to sell the property to their son or daughter for less than its market value.

Significant numbers of first home buyers get their foot into the property market buying buying a property off of their parents or a family member. If the parents have several investment properties then they may even choose to sell the property to their son or daughter for less than its market value. When applying for a mortgage, no doubt you have shopped around for the best interest rate and lowest fees. However almost nobody checks to see if their application meets the lenders guidelines & credit policy!

When applying for a mortgage, no doubt you have shopped around for the best interest rate and lowest fees. However almost nobody checks to see if their application meets the lenders guidelines & credit policy!