Mortgages In Australia: A Guide For Singapore Citizens

It is fairly popular for Singaporean citizens to purchase property in Australia, either as an investment, or to live in as a temporary resident. Find out how buying property can differ between the countries, and how you can apply.

It is fairly popular for Singaporean citizens to purchase property in Australia, either as an investment, or to live in as a temporary resident. Find out how buying property can differ between the countries, and how you can apply.

Does buying real estate differ in Australia?

When buying property in Australia, citizens of Singapore are treated the same way as other foreign citizens around the world. Despite the size of the country, real estate is not as available and affordable as one may assume.

What many people outside Australia do not realise, is that whilst land may be at a premium, land that is available for development, and properties to purchase, are not always easy to buy and afforible.

Do not worry! Mortgages brokers such as us here at the Home Loan Experts can help you find what you are after! We specialise in helping foreign citizens and temporary residents get Australian mortgages approved at competitive rates with low repayments.

For more information contact us on 1300 889 743 (when outside Australia call +61 2 9194 1700), or enquire online and one of our brokers will contact you.

What is a mortgage broker?

In nations such as Australia, the US, and the UK, the mortgage broking industry has existed for a very long time. However, much of the property in Singapore has been public housing so the industry there is fairly new. Therefore, many people in Singapore are not overly familiar with how they operate.

The services of a mortgage broker are free in Australia for most standard loan applications! This is because when a loan is approved, they are paid for their services by the banks themselves.

A broker operates as a mediator between you and a bank. Initially, you will take your details such as your employment, income, and savings to them. They will then assess your financial status and compare this to what the banks and lenders have on offer. Some brokers in Australia work with over 40 different financial institutions!

The mortgage broker should understand the lending policies of the different lenders, and apply to one they believe most likely to approve your application. This comparison also enables them to pick and choose, and often find better mortgages with lower fees and competitive rates.

Some people in Australia do apply to a bank or lender themselves. If this is the path you take it is important to remember that a bank will only offer you its own products. When you apply directly the bank has no competition, and is less likely to offer discounts on fees and interest rates.

Please also note! Every time you have a loan application declined in Australia, this goes on your permanent record. Known as your credit file, any negative financial transaction recorded here will lower the chance of approval next time you apply. This is one of the reasons why a broker can be a better option.

Do we need to apply for Australian Government approval?

Citizens and permanent residents of Singapore need to apply to the Foreign Investment Review Board (FIRB). This government body determines the level of foreign investment within Australia, including all types of real estate and property.

How much can we borrow?

In most cases, foreigners in Australia can borrow up to 70% or 80% of the value of the property they are purchasing. This is known as the loan to value ratio (LVR). In Singapore, this is known similarly, as the LTV ratio.

If you have a spouse or partner in Australia, you may be able to borrow up to 95% LVR. This is under the condition that legally, you live in the property together as joint tenants, not tenants in common. However, usually the amount is restricted to 90% LVR, or less.

When borrowing over 80% of the property value, note that you will most likely be required to pay insurance to cover the bank if you default on repayments. It is a one off payment at the commencement of your mortgage, and is known as lenders mortgage insurance (LMI).

Apply for an Australian mortgage today!

Do you have property or real estate in mind? We work with over 40 different banks and lenders, and can give you a greater chance of walking away with a great mortgage at competitive rates, on the property you desire.

Contact our specialist brokers on 1300 889 743 (when outside Australia call +61 2 9194 1700), or enquire online and they will contact you.

An interest in advance loan enables you to pre-pay the interest of the loan for the following financial year. These are available from a number of different lenders with fixed rates for a period of up to 5 years.

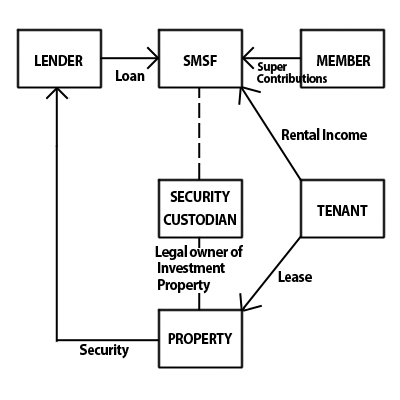

An interest in advance loan enables you to pre-pay the interest of the loan for the following financial year. These are available from a number of different lenders with fixed rates for a period of up to 5 years. A Self Managed Super Fund is a trust you use in order to manage your own superannuation. Basically instead of the employer provided super fund, you have direct control over your assets. This enables you to choose where you invest your money for your retirement.

A Self Managed Super Fund is a trust you use in order to manage your own superannuation. Basically instead of the employer provided super fund, you have direct control over your assets. This enables you to choose where you invest your money for your retirement. What is NRAS?

What is NRAS? Do you have approximately $150,000 in your Superannuation? If you do, you may be eligible for a Self-managed superannuation fund (SMSF) loan to purchase real estate with your Super!

Do you have approximately $150,000 in your Superannuation? If you do, you may be eligible for a Self-managed superannuation fund (SMSF) loan to purchase real estate with your Super!

What is Sepp 5 zoning?

What is Sepp 5 zoning? Investing in a foreign country is always risky. The business and mortgage practices are different, and you are not familiar with how stable that country is. For ‘would be’ investors in Australia there are a host of possible opportunities for purchasing real estate that can really earn you back your investment and make you some profits.

Investing in a foreign country is always risky. The business and mortgage practices are different, and you are not familiar with how stable that country is. For ‘would be’ investors in Australia there are a host of possible opportunities for purchasing real estate that can really earn you back your investment and make you some profits. when purchasing property in Australia has its benefits. This is true whether you are a foreigner or an Australian citizen. Investing in property and real estate and Australia is often low risk as value of property is constantly on the rise.

when purchasing property in Australia has its benefits. This is true whether you are a foreigner or an Australian citizen. Investing in property and real estate and Australia is often low risk as value of property is constantly on the rise.