Family Guarantee: Avoiding Lenders Insurance

When you know you have enough income to pay mortgage payments each month, but you simply don’t have enough money saved up to make a good deposit, this can be an extremely frustrating situation to deal with. You might be able to get approved for a mortgage with little or no down payment, but you’ll be forcing yourself to pay for unnecessary costs like lender’s insurance, and possibly a higher interest rate.

When you know you have enough income to pay mortgage payments each month, but you simply don’t have enough money saved up to make a good deposit, this can be an extremely frustrating situation to deal with. You might be able to get approved for a mortgage with little or no down payment, but you’ll be forcing yourself to pay for unnecessary costs like lender’s insurance, and possibly a higher interest rate.

Thankfully, avoiding lenders insurance is possible even if you don’t have a deposit saved up. If you have family with equity in a home of their own, or real estate that they are financially responsible for, you might not need to make a deposit at all. This is possible through something called a family guarantee.

Why Banks Require Lender’s Insurance

Before we discuss how a family guarantee can help you avoid lenders insurance, allow us to discuss why it exists in the first place. When a bank decides how to approach a borrower, they perform a complex calculation based on rules that determine how much of a risk you are to them.

As such, a bank has to plan ahead to deal with these risks. If you were to take out a home loan, only to find yourself in a situation where you could no longer pay it off, the bank finds itself in a precarious situation. They home now belongs to them, but it is of no value to them unless they sell it.

Banks are not home salesman, and they are not able to sell the home at its maximum value. In many cases, the bank is forced to sell the home for a loss. This is why they ask for a deposit in the first place. The deposit protects the bank from these losses.

But the bank does not feel protected from those losses if the deposit is too small. They have to find that protection elsewhere, so they hire an insurer. These lender’s insurance companies will cover the losses to the bank if you are no longer able to make your mortgage payments.

Of course, the bank has no reason to pay for the cost of lenders insurance themselves. If that were the only option, they would only lend out to people who could offer a large enough deposit. The banks don’t see it that way, however. They can simply ask the borrower to pay for the lenders insurance, and most borrowers who haven’t saved up a deposit are happy to do so, because they would rather not wait any longer.

How a Family Guarantee Resolves the Issue

With a family guarantee, the risks faced by the bank can be alleviated without making a large deposit and without paying for lender’s insurance. Through this process, the family member agrees to act as a guarantor. They are usually a parent, but they could also be a sibling or a grandparent. They then choose how much of the loan they will secure.

In most cases, the figure chosen is close to 20%. This is because 20% is the size of a deposit necessary in order to avoid lender’s insurance. While no deposit is needed in this case, the family guarantee serves the same purpose to the bank. Essentially, the family member is agreeing that they will be held liable for this amount of the loan if you fail to make your payments on time. They need to back up this claim using equity in a home of their own, or an investment property.

Assessing guarantor credit history is an important part of this process. Not only will the borrower be required to submit documentation. The guarantor will need to do so as well. They will also need to prove that they are financially and legally independent of you.

Benefits of a Family Guarantee

The most obvious benefit is that the borrower is not required to make a down payment in order to avoid or reduce the costs of lender’s insurance. This means that you will be able to buy a home sooner than you would otherwise be able to. You will be able to borrow for the full value of the home without any concerns, including the extra expenses (which usually amount to about 5% of the value of the home).

There are benefits to the guarantor as well. Not only are they able to help their family member buy a home, they can do so with very little risk to themselves. The situation is entirely different from cosigning a loan, which means that the family member could be held liable for the value of the entire home. They are only liable for the value that they have explicitly stated they are willing to secure.

Releasing the guarantee is also possible within a relatively short period of time. If the family member chose to secure 20% of the value of the home, for example, they could be released from the guarantee once 20% of the value of the home had been paid off. They could even be released if the value of the home increased by 20%.

To learn more about family guarantees, visit our website.

If a large percentage of your income comes from commission, you may need to apply for a commission income mortgage. This is when the lender marks down funds that you earn from commission or bonuses as a source of income that you will be using to pay for their mortgages. Considering the financial environment, it’s not surprising that the bank considers this a risky source of annual income.

If a large percentage of your income comes from commission, you may need to apply for a commission income mortgage. This is when the lender marks down funds that you earn from commission or bonuses as a source of income that you will be using to pay for their mortgages. Considering the financial environment, it’s not surprising that the bank considers this a risky source of annual income. Mortgage brokers play an important part in the success or failure of the economy. They facilitate the sale of mortgage loans, and make it easier for borrowers to find the best deal on a home loan. You can think of your broker as the middle man between you and your lender. Since it is less than easy to find the right lender for the right price, it is in your best interests to take advantage of the broker’s intimate knowledge on the subject.

Mortgage brokers play an important part in the success or failure of the economy. They facilitate the sale of mortgage loans, and make it easier for borrowers to find the best deal on a home loan. You can think of your broker as the middle man between you and your lender. Since it is less than easy to find the right lender for the right price, it is in your best interests to take advantage of the broker’s intimate knowledge on the subject. The Foreign Investment Review Board (FIRB) examines applications from overseas citizens (This includes those who live in Australia on a 457 Working Visa, and subclass 309 or 820 Temporary Resident Visas) who are looking to invest in property in Australia.

The Foreign Investment Review Board (FIRB) examines applications from overseas citizens (This includes those who live in Australia on a 457 Working Visa, and subclass 309 or 820 Temporary Resident Visas) who are looking to invest in property in Australia. Do you have approximately $150,000 in your Superannuation? If you do, you may be eligible for a Self-managed superannuation fund (SMSF) loan to purchase real estate with your Super!

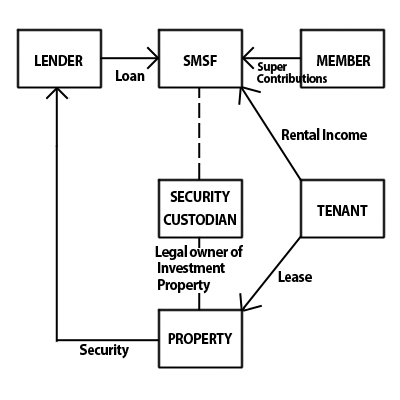

Do you have approximately $150,000 in your Superannuation? If you do, you may be eligible for a Self-managed superannuation fund (SMSF) loan to purchase real estate with your Super!

You may be disheartened by financial institutions that keep turning you down. The simple reality is that many banks see you as a higher risk because you are not as financially committed to staying in the country as an Australian Citizen or Permanent Resident. However not every lender has strict lending policies for foreign citizens living in Australia.

You may be disheartened by financial institutions that keep turning you down. The simple reality is that many banks see you as a higher risk because you are not as financially committed to staying in the country as an Australian Citizen or Permanent Resident. However not every lender has strict lending policies for foreign citizens living in Australia. The majority of Australian lenders have a policy requiring you to have “genuine savings” before they will approve your mortgage. In effect, it is proof of your ability to manage your money effectively and live within your means.

The majority of Australian lenders have a policy requiring you to have “genuine savings” before they will approve your mortgage. In effect, it is proof of your ability to manage your money effectively and live within your means. When you apply for a mortgage, your lender will calculate the Loan to Valuation Ratio (LVR) of your loan. This is an important part of their assessment criteria. The higher your LVR, the higher the risk to the bank in the event that you default on the loan.

When you apply for a mortgage, your lender will calculate the Loan to Valuation Ratio (LVR) of your loan. This is an important part of their assessment criteria. The higher your LVR, the higher the risk to the bank in the event that you default on the loan.